Table of Contents

Introduce about the PAN-Aadhaar link and its significance.

The mandatory connecting of a person’s Permanent Account Number (PAN) with their Aadhaar number, as required by the Indian government, is known as the PAN-Aadhaar connection. Aadhaar is a 12-digit unique identity number issued by the Unique identity Authority of India (UIDAI), whereas PAN is a unique 10-digit alphanumeric identifier issued by the Income Tax Department, mostly used for financial transactions. Streamlining financial transactions, decreasing tax evasion, and improving transparency are the main benefits of integrating PAN with Aadhaar. This connection aids in the government’s ability to monitor and authenticate a person’s financial transactions, which in turn supports the development of a more reliable and effective tax system.

Why the government has mandated the linking of PAN and Aadhaar?

The government has made it mandatory to link PAN and Aadhaar in order to accomplish a number of important goals:

1. Preventing Tax Evasion: One of the most important ways to stop tax evasion is to link PAN with Aadhaar. By doing this, the government can ensure that taxpayers truthfully disclose their income and assets by cross-verifying the financial transactions and income details that they submit.

2. Removal of Duplicate PAN Cards: The linkage aids in the detection and removal of duplicate PAN cards. By ensuring that every person has a distinct PAN, this lowers the possibility of fraud or abuse linked to multiple PANs.

3. Simplifying Financial Transactions: Financial transactions are made easier and more effective by connecting Aadhaar and PAN. It offers a single identity system that improves financial transactions' accuracy and transparency for the benefit of both people and the government.

4. Targeted Service Delivery: The government can more successfully target and provide subsidies, benefits, and services thanks to the linkage. Through Aadhaar-linked PAN, the government can guarantee that the intended recipients of its assistance programs receive correct and up-to-date information.

5. Improving Data Accuracy: An additional layer of authentication is added by Aadhaar, a biometric-based identity system. By connecting PAN to Aadhaar, people's information is kept current and correct, which lowers the possibility of identity theft and inconsistencies in financial records.

6. Boosting National Security: By offering a more dependable and verified identification system, the connection helps to strengthen national security. It facilitates the surveillance and monitoring of financial activity, making it more difficult for anyone to partake in illegal financial operations that could endanger national security.

7. Compliance with Legal Requirements: In accordance with notifications and laws, the government has mandated the PAN-Aadhaar link. It ensures that citizens carry out their responsibilities in accordance with the law by strengthening the framework of laws pertaining to financial rules and taxes.To summarise, the government’s directive to integrate PAN and Aadhaar is a calculated step towards improving the effectiveness of the taxation system, curbing misconduct, and guaranteeing improved governance and service provision. It is consistent with the overarching objectives of encouraging accountability, openness, and inclusion in financial transactions and public services.

The role of PAN (Permanent Account Number) in financial transactions.

The Permanent Account Number (PAN) is necessary for a variety of financial transactions in India. The following are some of PAN’s key characteristics and the reasons they are important for financial transactions:

- Unique Identification: PANs, or 10-digit alphanumeric unique identification numbers, are issued by the Income Tax Department of India. It serves as a universal identification key for tracking financial operations and is unique to each individual or entity.

- Needed for Taxation: PAN is necessary for certain tax-related purposes. A PAN is required for everyone and everything engaged in financial activities, such as receiving income, filing taxes, or engaging in high-value transactions.

- Income Tax Return Filing: To file an income tax return, you must have a PAN. By establishing a connection between a person’s financial activities and their taxable income, it makes it possible for the government to appropriately assess and collect taxes.

- Opening Bank Accounts: Whether opening a savings, current, or fixed deposit account, PAN is frequently needed. It is an essential KYC (Know Your Customer) document that assists in confirming the identification of the account holder.

- PAN is required for a number of investment-related activities. PAN information is necessary for those who trade stocks, mutual funds, buy or sell real estate, or engage in other financial activities.

- Property Transactions: When it comes to real estate transactions, PAN is crucial. When purchasing or selling real estate, people must record the transaction with their PAN. In order to combat black money in the real estate industry, this aids the government in tracking high-value property transactions.

- Loan Applications: PAN is frequently needed in order to apply for loans, such as auto, home, or personal loans. Lenders evaluate a borrower’s creditworthiness and adherence to legal criteria using PAN information.

- Foreign Exchange Transactions: If a foreign exchange transaction exceeds a predetermined threshold, PAN is required. This guarantees the surveillance of cross-border financial operations and the identification of those involved in significant foreign exchange transactions.

- Applications for Credit Cards: Generally, PAN information is needed in order to apply for credit cards. It helps credit card firms determine an applicant’s identification and evaluate their creditworthiness.

- Prevention of Tax Evasion: By connecting a person’s tax profile to a range of financial transactions, PAN acts as a tool to stop tax evasion. The government can detect irregularities and take appropriate action against tax evasion because to this connectivity.

The legal requirements and government notifications mandating the PAN-Aadhaar link

- Aadhaar and PAN linking is now required for all individuals according to the Finance Act of 2017. The original goals of this were to reduce tax evasion and build a stronger system for monitoring financial activities.

- Part 139AA of the 1961 Income Tax Act: Everybody who is qualified for Aadhaar must link it with their PAN, according to Section 139AA of the Income Tax Act, which was added by the Finance Act, 2017. It requires mentioning Aadhaar or the Aadhaar enrollment number when submitting income tax returns and registering for a new PAN card.

- 2018 Supreme Court ruling: The Income Tax Act’s Section 139AA, which mandates that Aadhaar and PAN be linked in order to file income tax returns, was confirmed by the Supreme Court of India as constitutionally legitimate in 2018.

- Notifications from the Income Tax Department: Over the years, the Income Tax Department has released a number of notifications outlining the steps and deadlines for integrating PAN with Aadhaar. To avoid any negative outcomes, taxpayers are usually obliged to link their PAN and Aadhaar by a certain date.

- Extended Deadlines: In order to provide people more time to finish the procedure, the deadlines for connecting PAN with Aadhaar have been extended. It is advisable that taxpayers look up the most recent deadline extensions on the official announcements.

- Online and Offline Linking Options: To link PAN with Aadhaar, the government has made both online and offline options available. To finish the connection process, taxpayers can use other approved means or go to the official income tax e-filing website.

- Consequences of Non-Compliance: Failure to comply with the PAN-Aadhaar linking requirement may result in penalties, PAN card invalidation, and trouble filing income tax returns.

Reducing tax evasion and promoting transparency.

Aadhaar and PAN (Permanent Account Number) linking is essential for lowering tax evasion and fostering tax system transparency. The following are the ways in which the relationship advances these goals:

Unique Identification:

An individual's biometric and demographic data are connected to their Aadhaar, a unique identifier. When PAN and Aadhaar are connected, a more reliable and distinct identity verification system is created, making it more difficult for people to utilize numerous PANs to avoid paying taxes.

Precise Income Reporting:

The connection aids in guaranteeing the accuracy of the income declared when completing income tax returns. Through cross-referencing the data present in the Aadhaar and PAN databases, the government can detect any inconsistencies or differences in the income declarations.

Minimizing Income Underreporting:

People occasionally underreport their income in order to avoid paying taxes. When the income details provided in the PAN and Aadhaar databases are compared, the linkage aids in the detection of such underreporting. People are discouraged from inflating their income as a result.

Data Cross-Verification:

To find instances of tax evasion, the government might cross-verify the data present in the PAN and Aadhaar databases. To make sure people are paying taxes on their true income, this method compares information about income, investments, and other financial transactions.

Enhanced Compliance Monitoring:

Tax authorities can more efficiently monitor and follow financial transactions thanks to the PAN-Aadhaar linkage. People are discouraged from evading taxes because they know that their financial activities are being watched carefully, thanks to the heightened surveillance.

Reducing the Movement of Black Money:

The connection supports the government's initiatives to reduce the flow of black money. It is harder for people to participate in hidden financial activities when every financial transaction is linked to a distinct PAN-Aadhaar combination.

Fast Detection of Defaulters:

Tax law noncompliance can be detected by authorities in a timely manner. The tax department may take prompt, focused action against individuals who are dodging taxes thanks to the linkage, which facilitates the efficient identification of tax defaulters.

Simplifying the Tax Assessment procedure:

The PAN-Aadhaar connection makes the tax assessment procedure run more smoothly and quickly. Authorities can shorten the time it takes to assess taxes by using the linked data to confirm the accuracy of income facts.

Transparency in Financial Transactions:

By compiling a thorough history of a person's financial transactions, the connection fosters transparency. Ensuring that everyone contributes fairly to government revenues and fostering trust in the tax system depend heavily on this transparency.Although the PAN-Aadhaar connection has a lot to offer in terms of reducing tax evasion and increasing transparency, privacy and data security issues must be addressed in order to preserve public confidence and compliance. Strict protocols ought to be implemented to protect the privacy of personal data.

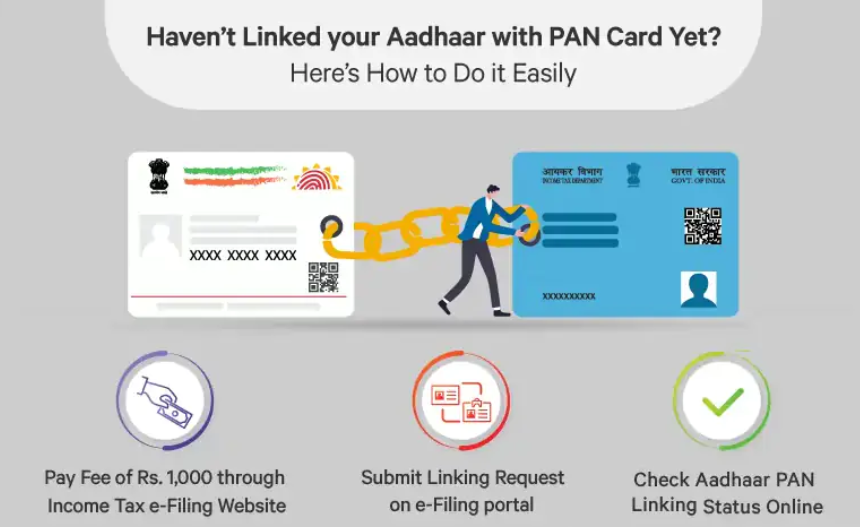

A step-by-step guide on how individuals can link their PAN with Aadhaar.

Online Method:

1. Visit the Official Income Taxe-Filing Website

Go to the sanctionede-filing website of the Income Tax Department of India

https//www.incometaxindiaefiling.gov.in/

2. Login or Register

log in using your credentials, If you’re formerly registered. However, you may need to register for a new account, If not.

3. Link Aadhaar formerly logged in,

look for the” Link Aadhaar” option. This may be set up under the” Profile Settings” or a analogous section.

4. Enter Details

Give the necessary details similar as your visage, Aadhaar number, and the name as mentioned in the Aadhaar card. Corroborate Details

5. Double- check

The information entered to insure delicacy. The linking will be successful only if the details match with the records.

6. OTP Authentication

An OTP (One- Time word) may be transferred to the mobile number linked with your Aadhaar. Enter the OTP to complete the authentication process.

7. Confirmation message

After successful verification, you should admit a evidence communication indicating that your visage has been linked with Aadhaar.

SMS system

1. Compose SMS

From your registered mobile number, send an SMS to the designated number in the format

UIDPAN<SPACE><12-digit Aadhaar><SPACE><10-character PAN>

For example: UIDPAN 123456789012 ABCDE1234F

2. Send SMS

Send the SMS to the specified number. Make sure your mobile number is registered with both Aadhaar and PAN.

3. Confirmation SMS

After processing, you should admit a confirmation SMS indicating the status of the linking process.

Through Income Tax Department’s e-filing website without login

- Visit the Income dutye-filing Website Go to https//www.incometaxindiaefiling.gov.in/

- Look for the” Link Aadhaar” option on the homepage. You might find it under the” Quick Links” section.

- Fill in Details Aadhaar number, and the name as per Aadhaar.

- Complete the captcha and click on the” Link Aadhaar” button.

- OTP Verification An OTP will be transferred to the mobile number linked with your Aadhaar.

- Enter the OTP to complete the verification process.

- Confirmation Message After successful verification, you should admit a evidence communication.